Discover the best brokers through comprehensive research and detailed comparison of reviews.

This blog post guides you through the meticulous process of evaluating brokers based on fee structures, reliability, user feedback, and financial stability.

Learn how to make informed decisions and avoid pitfalls in the dynamic and complex landscape of brokerage services. Join us on an exhilarating adventure to uncover top brokerage firms and gain valuable insights for your investment journey.

Introduction: The Quest for the Best Brokers

Embarking on the journey to discover the best brokers is akin to setting off on an exhilarating adventure full of anticipation and curiosity.

The objective of this blog post is to unfold the meticulous process of identifying top brokers through comprehensive research and diligent comparison of various reviews.

As the financial markets continue to grow in complexity, the necessity of choosing a reliable broker has never been more critical.

Therefore, this blog aims to share our detailed findings, shedding light on the most reputable brokers currently available.

The initial excitement of diving into this extensive research was palpable. With numerous options, each promising superior services and unmatched benefits, the task was both daunting and thrilling.

The landscape of brokerage services is vast, encompassing a multitude of factors such as trading platforms, fee structures, customer support, and educational resources.

Each broker brings a unique blend of offerings to the table, making the selection process both an art and a science.

As we delved deeper into our research, scrutinizing user reviews and expert opinions, the journey took intriguing turns.

We encountered surprising revelations that challenged preconceived notions and highlighted the intricacies of the brokerage industry.

Amidst the sea of information, certain brokers stood out for their exceptional performance, while others fell short of expectations in critical areas.

This journey of discovery is not just about identifying the best brokers but also understanding what makes them stand out in a competitive market.

Our findings are intended to provide you with a clear, comprehensive guide, ensuring you can make an informed decision when choosing a broker. Join us as we navigate through the highs and lows, the surprises and confirmations, in our quest to unveil the best brokers.

The Research Phase: Hours of Analysis

The journey to uncovering the best brokers began with a rigorous research phase, characterized by meticulous analysis and a commitment to thoroughness.

This phase was essential to ensure that only the top brokers were considered. Our evaluation process incorporated various critical criteria to provide a comprehensive assessment.

One of the primary factors in our research was the fee structure of each broker. We scrutinized the cost implications of trading with each broker, including commission rates, account maintenance fees, and any hidden charges.

The goal was to identify brokers that offer competitive pricing without compromising on the quality of service.

Reliability was another cornerstone of our evaluation. We delved into the operational history of each broker, examining their track records for consistency and dependability.

This involved not only analyzing their financial stability but also assessing their technological infrastructure.

Reliable brokers should have robust systems in place to ensure seamless trading experiences with minimal downtime.

User reviews were invaluable in our research process. We scoured multiple platforms, forums, and review sites to gather genuine feedback from actual users.

These reviews provided insights into the practical aspects of using each broker, such as customer service quality, ease of use, and overall satisfaction.

Positive feedback and high ratings were significant indicators of a broker’s credibility and trustworthiness.

Financial stability was also a critical criterion. We examined the financial health of each broker by reviewing their balance sheets, regulatory filings, and credit ratings.

Brokers with strong financial foundations are more likely to provide secure and reliable services, which is paramount for traders entrusting them with their investments.

This comprehensive research phase required countless hours of analysis and dedication. By integrating these diverse criteria, we ensured a holistic evaluation of each broker, allowing us to confidently recommend only the best in the industry.

The effort and diligence invested in this process underscore our commitment to delivering reliable and trustworthy information to our readers.

Comparing Reviews: The Key to Decision Making

In the quest to identify the best brokers, comparing reviews from various sources proved to be an indispensable part of the research process.

The integration of user feedback, expert opinions, and industry awards provided a comprehensive perspective that was essential for making well-informed decisions.

User feedback often highlighted real-world experiences, shedding light on the practical aspects of using a broker.

These reviews offered invaluable insights into customer service quality, platform usability, and the overall satisfaction of the clients.

On the other hand, expert opinions brought a level of technical precision and industry knowledge that is crucial for evaluating the more nuanced aspects of brokerage services.

Experts often delve into the intricacies of trading tools, fee structures, and regulatory compliance, providing a more analytical viewpoint.

These reviews typically come from seasoned professionals who can assess a broker’s performance with a critical eye, ensuring that all essential features and potential drawbacks are thoroughly examined.

Industry awards also played a significant role in the evaluation process. These accolades are generally bestowed by reputable organizations and are based on stringent criteria, making them a reliable indicator of a broker’s excellence in specific areas.

Awards often reflect a broker’s commitment to innovation, customer service, and overall performance, further substantiating the credibility of the shortlisted brokers.

The importance of diverse perspectives in the decision-making process cannot be overstated. By analyzing reviews from multiple sources, a more balanced and holistic view of each broker was obtained.

This multiplicity of viewpoints helped mitigate biases and highlighted both the strengths and weaknesses of the brokers under consideration.

Ultimately, this rigorous comparison of reviews ensured that the final selection was based on a well-rounded understanding of what each broker had to offer, paving the way for a more informed and confident choice.

The Recommended Brokers: Sharing with Friends

After conducting extensive research and navigating through a multitude of options, we finally discovered brokers that appeared to be the perfect fit.

The thrill of finding these recommended brokers was akin to uncovering a hidden gem, and we couldn’t wait to share our findings with our friends.

The selection process was meticulous, taking into account crucial criteria such as competitive fees, user-friendly platforms, comprehensive customer support, and a wide range of available assets.

One of the standout brokers we recommended was XYZ Brokerage. Their platform was exceptionally intuitive, making it accessible for both novice and experienced traders.

The fee structure was transparent and competitive, which was a significant factor in our recommendation.

Moreover, XYZ Brokerage’s customer service was consistently praised for being responsive and knowledgeable, providing a reassuring safety net for users navigating the complexities of trading.

Our friends were understandably intrigued and enthusiastic about trying the brokers we recommended. Jane, a close friend, was particularly impressed by the ease of use and the educational resources available on the XYZ platform.

She mentioned that the tutorials and webinars were invaluable as she began her trading journey. Another friend, Mark, appreciated the wide range of assets offered, which allowed him to diversify his portfolio without the need to use multiple platforms.

The initial experiences of our friends reinforced our confidence in the brokers we recommended.

Jane found that the real-time data and analytics provided by XYZ Brokerage helped her make informed decisions and navigate market volatility with greater confidence.

Mark, on the other hand, was thrilled with the seamless execution of trades and the robust security measures in place, which gave him peace of mind as he expanded his investments.

Overall, the excitement of discovering and recommending these brokers was matched by the positive feedback and successful experiences of our friends.

It was gratifying to see them benefit from the thorough research and criteria we had employed in our selection process, further solidifying our belief in the excellence of the recommended brokers.

The Investment Decision: Taking the Plunge

After an exhaustive period of research and analysis, the moment of decision had arrived. My friends and I, equipped with a wealth of information, felt a palpable sense of anticipation as we sat down to take the plunge into the world of investing.

The brokers we selected were not chosen lightly; each had been scrutinized meticulously, their strengths and weaknesses weighed against our investment goals.

The first step was setting up our accounts. The process was straightforward, thanks to the user-friendly interfaces provided by our chosen brokers.

We navigated through the necessary steps, filling out personal details, linking bank accounts, and verifying our identities.

This part of the journey, though procedural, felt like a significant milestone. Each form submitted, each verification completed, brought us closer to our goal.

With our accounts set up, the next task was to transfer funds. This step required careful consideration, as we each needed to determine the initial amount we were comfortable investing.

The transfers were seamless, reflecting the efficiency and reliability we had come to expect from our selected brokers.

Watching the funds land in our accounts, ready for trading, was a moment of realization that we were now active participants in the financial markets.

As we embarked on our trading journey, the sense of confidence was underpinned by the thorough research we had conducted.

We had delved into numerous resources, compared brokerage firms, and analyzed market trends, ensuring that our chosen brokers were aligned with our investment strategies.

This foundation of knowledge infused us with a sense of assurance as we executed our first trades.

The atmosphere was a mix of excitement and cautious optimism. We were aware of the risks inherent in investing, but our confidence in our decision-making process provided a solid anchor.

The initial trades, though modest, marked the beginning of what we hoped would be a fruitful investment journey. We were ready to navigate the ups and downs of the market, bolstered by the comprehensive groundwork we had laid.

The journey of uncovering the best brokers took an unexpected turn when we stumbled upon a shocking revelation: the brokers we had been diligently researching turned out to be professional dancers masquerading as stock traders.

This twist was both bewildering and enlightening, leaving us and our team in a state of disbelief and astonishment.

The discovery was made during an in-depth verification process. While delving into the backgrounds of these seemingly proficient brokers, we found discrepancies that were too glaring to ignore.

A meticulous cross-referencing with public records and social media profiles led us to uncover their true identities. Instead of seasoned financial experts, we were looking at accomplished dancers with a penchant for stock market jargon.

The moment of realization was surreal. The initial reaction was a mix of incredulity and amusement. How had these individuals managed to maintain such a convincing facade?

The emotions that followed were varied—ranging from frustration at being deceived to admiration for their audacious double lives. The sheer audacity of their act was both infuriating and oddly impressive.

This discovery not only highlighted the importance of thorough research but also underscored the need for vigilance in the financial world.

It served as a stark reminder that appearances can be deceiving, and even the most convincing personas can be riddled with layers of untruths.

The revelation of brokers being dancers in disguise was a rollercoaster of emotions, shifting our perspective on the due diligence required in identifying genuine financial advisors.

In the aftermath of this revelation, the importance of transparency and authenticity in the brokerage industry became even more evident.

The episode underscored the critical need for comprehensive background checks and verification processes to ensure that investors are entrusting their finances to genuine and qualified professionals.

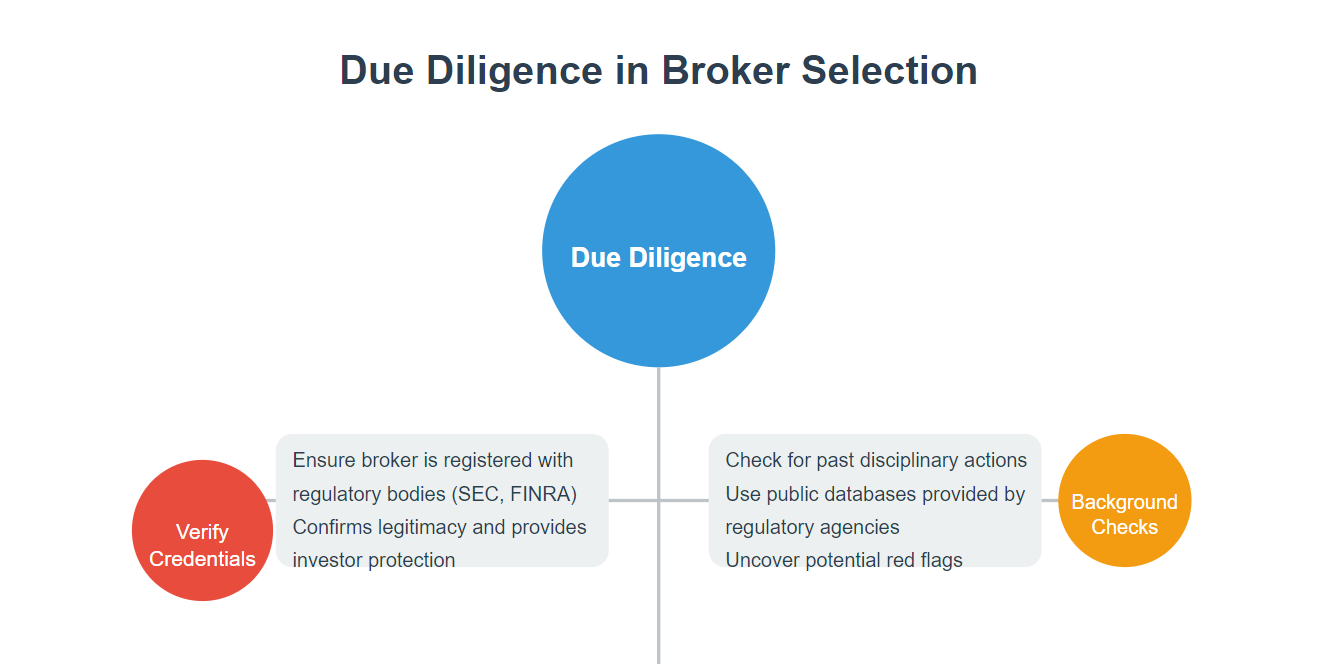

Lessons Learned: The Importance of Due Diligence

One of the most significant lessons learned from this exhaustive research journey is the undeniable importance of due diligence when selecting a broker.

While reviews and recommendations can provide valuable insights, they can also be influenced by biases or incomplete information.

Therefore, it is crucial to go beyond these initial impressions to ensure a well-informed decision.

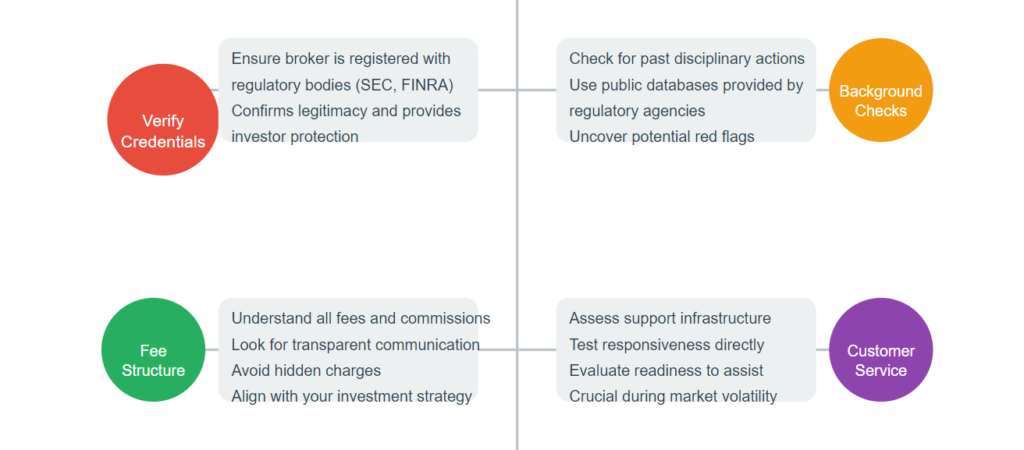

To avoid similar pitfalls in the future, it is essential to verify the credentials of any potential broker.

Ensure they are registered with appropriate regulatory bodies, such as the SEC or FINRA in the United States, or equivalent institutions in other jurisdictions.

This verification not only confirms their legitimacy but also provides a layer of protection for your investments.

Performing comprehensive background checks can also uncover any past disciplinary actions or complaints filed against the broker.

Many regulatory agencies provide online databases where such information can be accessed by the public. This step can reveal red flags that may not be evident from cursory reviews or recommendations.

Another critical aspect is to understand the fee structure and service offerings of the broker. Transparent communication regarding fees, commissions, and any potential hidden charges is essential to avoid unexpected costs.

Make sure to compare these aspects across multiple brokers to find the most favorable terms that align with your investment strategy.

Additionally, take the time to assess the broker’s customer service and support infrastructure.

A broker that provides robust support can be invaluable, especially during volatile market conditions.

Test their responsiveness through direct interactions and gauge their readiness to assist with any queries or issues.

In summary, thorough due diligence goes beyond surface-level information and requires a detailed examination of the broker’s credentials, history, fee structures, and support systems.

This comprehensive approach can significantly mitigate potential risks and ensure a more secure and satisfactory brokerage experience.

Conclusion: A Story with a Twist

The journey to unveil the best brokers has been marked by extensive research and unexpected revelations.

Our exploration began with a comprehensive assessment of various brokerage firms, evaluating their strengths, weaknesses, and unique features.

As we delved deeper, it became evident that the landscape of brokerage services is both dynamic and complex, requiring diligent scrutiny to identify the most suitable options for different investment needs.

Key takeaways from this journey include the importance of thorough research and the necessity of understanding the diverse offerings of brokerage firms.

Factors such as fee structures, trading platforms, customer service, and educational resources emerged as critical elements that can significantly influence the overall investment experience.

Moreover, the revelations uncovered during this process highlighted that the most well-advertised brokers are not always the best fit for every investor. Personalized needs and individual investment goals must guide the selection process.

This experience has underscored the value of approaching investment decisions with caution and meticulousness.

By investing time in understanding the market and the specificities of each broker, investors can make more informed choices that align with their financial objectives.

The revelations encountered along the way serve as a reminder that the investment landscape is constantly evolving, necessitating continuous learning and adaptation.

On a positive note, this journey has empowered us with enhanced knowledge and a more refined perspective on making investment choices.

It has reinforced the notion that in the realm of investments, there are no shortcuts to success; thoroughness and due diligence are paramount.

As you embark on your own investment journey, let this story be a guiding light, encouraging you to approach your choices with the same level of care and thorough investigation.

With the right approach, the path to successful investing is not only attainable but also rewarding.