Best Stock Brokers: Discover top-rated firms that empower your trading and investing success. Start maximizing your returns today!

Table of Contents

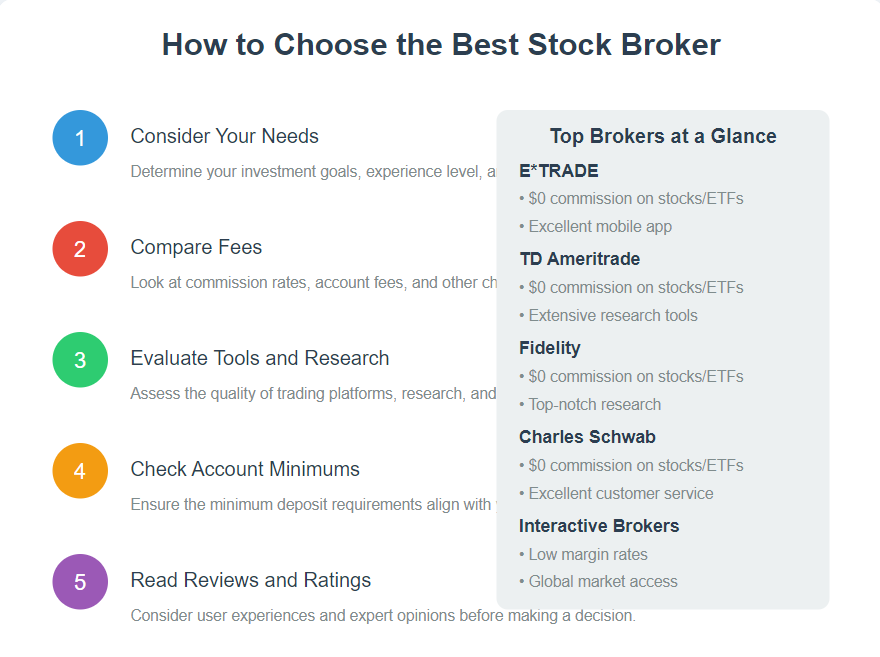

Choosing the right stock broker is crucial for successful trading and investing. With numerous options available, it can be challenging to determine which broker best suits your needs.

This article will guide you through the key factors to consider when selecting a stock broker and highlight some of the best stock brokers available in the market.

By the end of this article, you’ll have a clear understanding of the features, benefits, and unique selling points of each broker, helping you make an informed decision.

Factors to Consider When Choosing a Stock Broker

Brokerage Fees: One of the most important factors to consider is the brokerage fees. High fees can significantly impact your trading profits. Look for brokers that offer competitive pricing and low commission rates, Some brokers even offer commission-free trading for certain types of investments.

Trading Platform: A user-friendly and feature-rich trading platform is essential for efficient trading. The platform should offer advanced charting tools real-time market data, and easy-to-use interfaces. Additionally, mobile trading apps are becoming increasingly important for traders who want to manage their portfolios on the go.

Investment Options: The variety of investment options available is another crucial factor. Look for brokers that offer a wide range of investment products, including stocks, ETFs, mutual funds, bonds, and options. Diversifying your portfolio can help mitigate risks and maximize returns.

Customer Service: Responsive and knowledgeable customer support is vital for addressing any issues or questions you may have. Look for brokers that offer multiple channels of support, such as live chat, email, and phone support. Quick resolution of problems can make a significant difference in your trading experience.

Educational Resources: Educational materials and tools are invaluable for improving your trading skills. Look for brokers that provide comprehensive educational resources, including articles, webinars, tutorials, and market analysis. These resources can help you stay informed and make better trading decisions.

Trading Tools: Advanced trading tools and research capabilities can give you an edge in the market. Look for brokers that offer tools such as screeners, calculators, and in-depth market research. These tools can help you identify potential trading opportunities and optimize your strategies.

Best Stock Brokers

Best Stock Brokers: Dive into our comparison of E TRADE, TD Ameritrade, Fidelity, Charles Schwab, and Interactive Brokers to find your perfect match!

Broker 1: E*TRADE

Overview: E*TRADE is a well-established online broker known for its comprehensive trading platform and extensive educational resources.

Features:

- Commission-free trading for stocks and ETFs.

- Advanced trading platform with powerful charting tools.

- Wide range of investment options, including stocks, ETFs, mutual funds, and options.

- Comprehensive educational resources, including articles, webinars, and tutorials.

- Responsive customer support with multiple channels.

Pros and Cons:

- Pros:

- User-friendly trading platform.

- Extensive educational resources.

- Competitive pricing and low commission rates.

- Cons:

- Higher fees for options trading.

- Some advanced features may be overwhelming for beginners.

Broker 2: TD Ameritrade

Overview: TD Ameritrade is a leading online broker that offers a robust trading platform and a wide range of investment options.

Features:

- Commission-free trading for stocks and ETFs.

- Powerful trading platform with advanced charting tools and real-time market data.

- Wide range of investment options, including stocks, ETFs, mutual funds, and options.

- Comprehensive educational resources, including articles, webinars, and market analysis.

- Responsive customer support with multiple channels.

Pros and Cons:

- Pros:

- Advanced trading platform with powerful tools.

- Extensive educational resources.

- Competitive pricing and low commission rates.

- Cons:

- Higher fees for options trading.

- Some advanced features may be overwhelming for beginners.

Broker 3: Fidelity

Overview: Fidelity is a well-known broker that offers a comprehensive suite of investment options and a user-friendly trading platform.

Features:

- Commission-free trading for stocks and ETFs.

- User-friendly trading platform with advanced charting tools.

- Wide range of investment options, including stocks, ETFs, mutual funds, and options.

- Comprehensive educational resources, including articles, webinars, and market analysis.

- Responsive customer support with multiple channels.

Pros and Cons:

- Pros:

- User-friendly trading platform.

- Extensive educational resources.

- Competitive pricing and low commission rates.

- Cons:

- Higher fees for options trading.

- Some advanced features may be overwhelming for beginners.

Broker 4: Charles Schwab

Overview: Charles Schwab is a reputable broker that offers a wide range of investment options and a user-friendly trading platform.

Features:

- Commission-free trading for stocks and ETFs.

- User-friendly trading platform with advanced charting tools.

- Wide range of investment options, including stocks, ETFs, mutual funds, and options.

- Comprehensive educational resources, including articles, webinars, and market analysis.

- Responsive customer support with multiple channels.

Pros and Cons:

- Pros:

- User-friendly trading platform.

- Extensive educational resources.

- Competitive pricing and low commission rates.

- Cons:

- Higher fees for options trading.

- Some advanced features may be overwhelming for beginners.

Broker 5: Interactive Brokers

Overview: Interactive Brokers is a leading online broker that offers a powerful trading platform and a wide range of investment options.

Features:

- Low commission rates for stocks and ETFs.

- Advanced trading platform with powerful charting tools and real-time market data.

- Wide range of investment options, including stocks, ETFs, mutual funds, and options.

- Comprehensive educational resources, including articles, webinars, and market analysis.

- Responsive customer support with multiple channels.

Pros and Cons:

- Pros:

- Advanced trading platform with powerful tools.

- Extensive educational resources.

- Competitive pricing and low commission rates.

- Cons:

- Higher fees for options trading.

- Some advanced features may be overwhelming for beginners.

Comparison Table

| Broker | Commission-Free Trading | Advanced Trading Platform | Investment Options | Educational Resources | Customer Support |

|---|---|---|---|---|---|

| E*TRADE | Yes | Yes | Wide range | Comprehensive | Multiple channels |

| TD Ameritrade | Yes | Yes | Wide range | Comprehensive | Multiple channels |

| Fidelity | Yes | Yes | Wide range | Comprehensive | Multiple channels |

| Charles Schwab | Yes | Yes | Wide range | Comprehensive | Multiple channels |

| Interactive Brokers | Low commission rates | Yes | Wide range | Comprehensive | Multiple channels |

Key Factors to Consider When Choosing a Stock Broker

When selecting a stock broker, investors must evaluate several crucial factors to make a well-informed decision.

One of the foremost considerations is the fees and commissions associated with trading. Different brokers have varying fee structures, which can significantly impact your overall investment returns.

Assessing both the size and frequency of these fees can help you avoid unexpected costs and ensure that the broker aligns with your budget and trading strategy.

The range of available investment options is another vital factor. Brokers offer access to different types of securities, including stocks, bonds, mutual funds, ETFs, and options. A diversified portfolio is often key to minimizing risk while maximizing returns.

Therefore, it is essential to choose a broker that provides a wide array of investment options to tailor your portfolio according to your financial goals and risk tolerance.

Trading platforms are integral to the trading experience. A robust platform equipped with user-friendly interface, real-time data, and advanced tools can greatly enhance your trading efficiency.

Investors should look for brokers that offer state-of-the-art platforms with effective order execution, mobile compatibility, and customizable features to suit both novice and experienced traders.

Exceptional customer service is another critical element. Responsive and knowledgeable support can be the difference between a seamless trading experience and a frustrating one. Investigate the different customer service channels offered, such as phone support, email, live chat, and their availability.

Reading reviews and feedback from other customers can provide insights into the reliability of a broker’s customer service.

Research tools and educational resources offered by a broker can empower investors. Quality research tools, including market analysis, stock screeners, and financial news, enable informed decision-making.

Meanwhile, educational resources such as tutorials, webinars, and articles are invaluable for those looking to expand their investing knowledge and skills.

Each of these factors plays a critical role in selecting the best stock broker for your needs. By carefully evaluating these aspects, investors can ensure they partner with a broker that supports their financial ambitions effectively and efficiently.

Types of Stock Brokers

When selecting a stock broker, understanding the various types of brokers available is paramount. Broadly, stock brokers fall into three categories: full-service brokers, discount brokers, and robo-advisors. Each type presents unique benefits and drawbacks that cater to different investor needs and preferences.

Full-Service Brokers

Full-service brokers offer comprehensive services, including personalized financial advice, portfolio management, and a wide array of investment products.

They are ideal for individuals who prefer expert guidance and a hands-on approach to investing. The primary advantage of full-service brokers is the personalized service and in-depth research they provide. However, this comes at a cost.

Full-service brokers typically charge higher fees and commissions, making them more suitable for investors with larger portfolios or those who value professional advice over cost considerations.

Discount Brokers

Discount brokers, on the other hand, provide a no-frills approach to stock trading. They enable investors to conduct their own research and trading without the added cost of advisory services.

The main advantage of discount brokers is their affordability, offering lower fees and commissions than full-service brokers.

This makes them an attractive option for cost-conscious investors and those who prefer a self-directed investment strategy. However, the lack of personalized advice means that investors need to be confident and well-versed in their market knowledge.

Robo-Advisors

Robo-advisors represent a modern innovation in the brokerage industry, leveraging algorithms and AI to manage investment portfolios.

These digital platforms automatically allocate and rebalance investments based on the client’s goals and risk tolerance. The benefits of robo-advisors include lower fees compared to traditional brokers and the ease of use for hands-off investors.

They are particularly advantageous for those new to investing or individuals who prefer a set-it-and-forget-it approach. Nevertheless, the drawback lies in the lack of human interaction, which might not appeal to investors seeking personalized financial guidance.

Each type of stock broker has its distinct advantages and disadvantages, catering to varying investor preferences and needs.

Whether one prioritizes personalized advice, cost-efficiency, or automated management, understanding these options is crucial in selecting the best stock broker for one’s investment journey.

How to Compare Stock Brokers

When comparing stock brokers, it is essential to have a systematic approach to evaluate each broker accurately.

By focusing on critical criteria such as fees, ease of use, customer service, research tools, and technology, you can make an informed decision.

Here is a step-by-step guide to help you compare stock brokers effectively:

1. Evaluate Fees and Commissions

The first step in comparing stock brokers is understanding their fee structure. This includes trading commissions, account maintenance fees, and any hidden costs. Look for brokers that offer competitive rates without compromising the quality of service.

Also, consider any additional charges for transferring assets or accessing premium features.

2. Assess Ease of Use

A user-friendly interface can significantly impact your trading experience. Evaluate the broker’s platform by navigating through their website or mobile app. Check if the interface is intuitive, customizable, and equipped with features that cater to your trading style. A well-designed platform should make the trading process seamless and efficient.

3. Gauge Customer Service and Support

Exceptional customer service is crucial for handling issues promptly. Test the broker’s customer support by contacting them through various channels – phone, email, live chat, or social media. Assess the responsiveness and quality of support provided. Reliable customer service can be a valuable asset, especially during critical trading moments.

4. Compare Research Tools and Resources

Access to reliable research tools can enhance your trading decisions. Compare the research features each broker offers, including market analysis, stock ratings, educational resources, and news updates. A comprehensive suite of research tools can provide valuable insights and help you stay informed about market trends.

5. Examine Technology and Innovation

Technology plays a vital role in modern trading. Evaluate the technological capabilities of each broker, such as real-time data, trading algorithms, and integration with third-party applications. Consider brokers that invest in advanced technology to provide a superior trading experience.

By systematically evaluating stock brokers based on these criteria, you can rank them according to your personal and financial priorities. This methodical approach ensures that you select a broker who best fits your trading needs and goals.

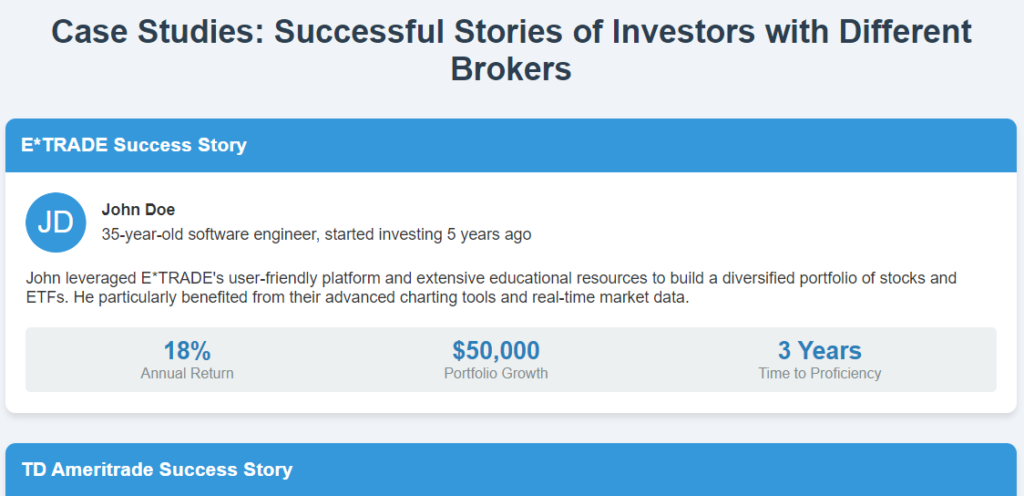

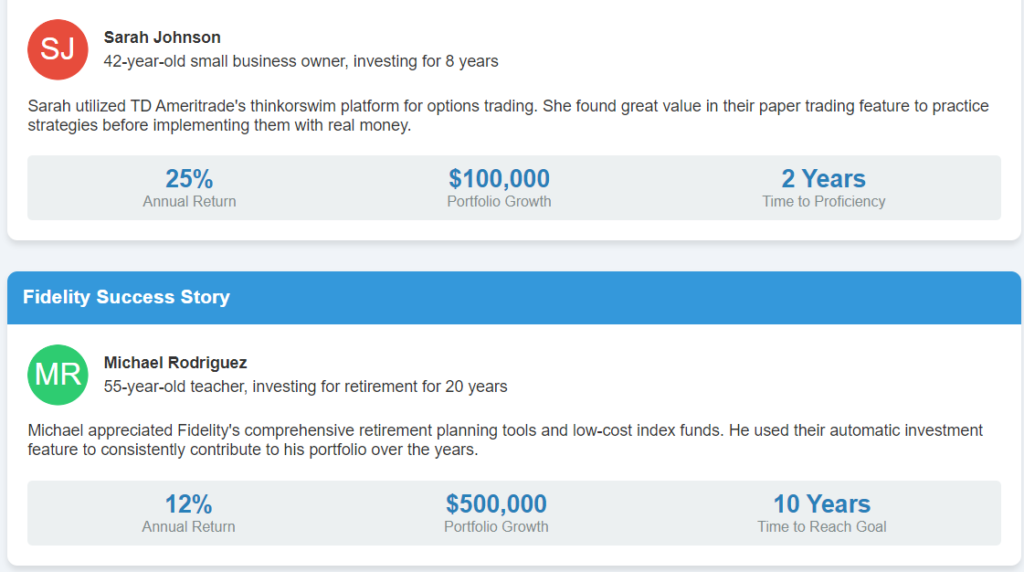

Case Studies: Successful Stories of Investors with Different Brokers

Choosing the right stock broker can profoundly impact an investor’s journey, aligning with specific needs and preferences. Here, we share real-life case studies of investors who successfully navigated the market with the assistance of different brokers, showcasing their varying experiences and outcomes.

Mary, a seasoned investor with a penchant for technology stocks, opted for a well-known online brokerage firm.

She was particularly drawn to their robust research tools and real-time data analytics. The comprehensive resources available enabled me to make informed decisions swiftly.

Mary said. Her broker’s advanced platform played a crucial role, helping her achieve impressive returns, especially during volatile market periods.

John, a new entrant in the stock market, chose a brokerage firm renowned for its educational resources and customer support. As a beginner, the diligent support and informative webinars provided by my broker were invaluable, John shared.

The hands-on assistance helped him understand complex trading concepts, preventing costly mistakes and enhancing his confidence in managing his investments.

Emily, focused on socially responsible investing, sought a broker with a clear emphasis on ethical investments. She partnered with a firm recognized for its ESG (Environmental, Social, and Governance) screening capabilities.

My broker’s commitment to ESG principles resonated with my values, allowing me to align my portfolio with my beliefs. Emily noted. She appreciated the broker’s dedication to ethical investing, contributing to her financial success without compromising on her principles.

Lastly, Richard, a retiree seeking steady income, gravitated towards a broker specializing in fixed-income products.

The tailored advice and extensive portfolio management services I received were exemplary, Richard remarked. His broker’s expert guidance helped him create a balanced portfolio focused on long-term stability and income generation, securing his retirement plans.

Common Mistakes to Avoid When Choosing a Stock Broker

Choosing the right stock broker is a critical step in an investor’s journey, and avoiding common pitfalls can make a significant difference.

One of the primary mistakes investors make is prioritizing low fees over quality service. While it is essential to minimize costs, an overly frugal approach may lead to subpar customer service, insufficient research tools, or unreliable trading platforms.

A balance between cost and quality should be maintained, ensuring that the selected broker offers value-added services and robust support.

Another common error is failing to understand the fine print in the broker’s terms and conditions. Hidden fees, margin rates, and other charges can significantly impact profitability. It’s crucial to thoroughly review the fee structure and all associated costs.

Investors should also be aware of the account maintenance requirements, withdrawal conditions, and any potential inactivity fees. A transparent, clear understanding of these factors is vital to avoid unpleasant surprises down the line.

Neglecting to test the broker’s trading platform can also be a costly mistake. A user-friendly, reliable, and responsive platform is pivotal for a seamless trading experience.

Prior to committing, investors should test the demo account or trial version to evaluate the platform’s navigation, execution speed, and available tools.

The availability of educational resources and customer support can further enhance user experience. A well-equipped platform can significantly streamline trading activities, promoting better decision-making.

Lastly, not considering the broker’s reputation and regulatory compliance is a critical oversight. Investors should ensure that the broker is well-established, financially stable, and regulated by recognized authorities.

Researching customer reviews and ratings can provide insights into the broker’s reliability and service quality. Proper due diligence helps safeguard investments and aligns with long-term financial goals.

By sidestepping these common pitfalls and carefully evaluating key factors, investors can choose a stock broker that aligns with their needs, ensuring a secure and efficient trading journey.

Conclusion

Choosing the best stock broker is a critical decision that can significantly impact your trading and investment success.

By considering factors such as brokerage fees, trading platform, investment options, customer service, educational resources, and trading tools, you can make an informed decision.

The brokers highlighted in this article—E*TRADE, TD Ameritrade, Fidelity, Charles Schwab, and Interactive Brokers—are among the best in the market, each offering unique features and benefits.

Take the time to evaluate your needs and choose the broker that best aligns with your trading and investment goals.

Ready to take your trading and investing to the next level? Visit the websites of the mentioned brokers for more information and explore their features. Use the comparison table provided to help you make an informed decision. Start your journey to successful trading and investing today!