Forex Factory delivers the latest news and updates in the world of trading. Stay ahead with our real-time insights and analysis.

Table of Content

Welcome to the hub of real-time financial updates and market insights – Forex Factory Dive into the dynamic world of currency trading as we bring you the latest news straight from the heart of the forex industry.

From major economic announcements to geopolitical events shaping global markets, our team at Forex Factory is dedicated to keeping you informed and ahead of the curve.

1. Overview of Forex Factory Significance

– Forex Factory pivotal in currency trading for novices and experts.

– Evolved beyond economic calendar to comprehensive market analysis hub.

– Bridges theory and practice with real-time insights.

– Democratizes information, making complex analytics accessible.

– Fosters vibrant community for innovation in trading strategies.

– Leverages collective intelligence for fresh market perspectives.

– Enables confident navigation through economic uncertainties.

Forex Factory emerges as a pivotal force in the labyrinth of currency trading, serving both novice traders and financial maestros with an arsenal of tools tailored to enhance their trading strategies.

This platform transcends its basic function as an economic calendar, evolving into a comprehensive hub where market sentiments are not just gauged but also meticulously analyzed.

It stands out by bridging the gap between theoretical knowledge and practical application, providing real-time insights that empower users to make informed decisions amidst the volatile nature of forex markets.

The true significance of Forex Factory lies in its ability to democratize information, breaking down complex market analytics into digestible formats accessible to individuals at various stages of their trading journey.

It fosters a vibrant community where ideas and strategies intermingle, paving the way for innovation and refined approaches to currency trading.

By leveraging collective intelligence and cutting-edge technology, Forex Factory offers fresh perspectives on market trends, enabling traders to navigate through economic uncertainties with confidence and precision.

2. Current Trends in the Forex Market

– Geopolitical events increasingly influence Forex market, causing volatility and opportunities.

– Traders now need sophisticated tools to analyze real-time geopolitical developments.

– Technological advancements have led to an increase in algorithmic trading.

– Understanding algorithmic patterns crucial for traders in the digital-driven forex era.

In the ever-evolving landscape of the Forex market, one noticeable trend is the increasing influence of geopolitical events. Traders and investors alike are now more than ever attuned to global news, be it elections, trade agreements or conflicts.

This heightened sensitivity has made currency markets more volatile but also opened up opportunities for those who can swiftly decipher and act on these global cues.

The dynamic interplay between politics and forex trading has pushed market participants to develop more sophisticated analytical tools that factor in real-time geopolitical developments.

Moreover, technological advancements have significantly impacted the Forex market, leading to an increase in algorithmic trading. Algorithms that can process vast amounts of data at speeds no human trader can match are now a dominant force.

This shift towards automation has not only changed how trades are executed but also how markets react to news and events.

As a result, understanding these algorithmic patterns and their effects on liquidity and price action has become crucial for traders aiming to stay ahead in this digital-driven era of forex trading.

3. Impact of Global Events on Forex Trading

– Global events significantly influence Forex trading, affecting currency values worldwide.

– Political or economic changes can create short-term trading opportunities through currency value shifts.

– Forex market’s volatility highlights the importance of understanding global news for traders.

– Pandemics can disrupt traditional forex patterns, leading to high volatility.

– Staying informed and adaptable is crucial for forex traders to manage risks and capitalize on opportunities.

Global events, from geopolitical shifts to economic announcements, operate as catalysts in the ever-vibrant world of Forex trading, often dictating the rhythm and flow of currency values across the globe.

The nuanced dance of global currencies on this stage brings to light an intriguing aspect of forex trading: its inherent interconnectedness with world events.

For instance, a political upheaval in a country can lead to a sudden depreciation of its currency against others, offering traders short-term gains if predicted accurately.

This dynamic interplay not only underscores the volatility and opportunities within the forex market but also demands a keen awareness and understanding of global news.

Moreover, unexpected global events like pandemics have demonstrated their capacity to disrupt traditional forex patterns, ushering in periods of unprecedented volatility.

Such scenarios reveal how swiftly sentiment can shift in forex markets, serving as poignant reminders for traders about the importance of staying informed and adaptable.

In essence, analyses that incorporate an understanding of geopolitical and economic landscapes afford traders not just insights into potential market movements but also equip them with strategies for managing risks more effectively.

Through this lens, navigating through the ebbs and flows of global events becomes an intricate art form in itself within forex trading.

4. Technological Advances Shaping Forex Strategies

– Technological advances have transformed forex trading with AI, machine learning, and advanced analytics.

– Machine learning enables quick data analysis and accurate prediction of market behaviors.

– Blockchain enhances transparency and security in forex transactions, reducing fraud risks.

– Adoption of cryptocurrencies in forex markets is increasing due to secure operations.

– Traders leveraging technology are leading a revolution in trading strategies and decision-making.

Technological advances have undeniably opened new frontiers for forex trading, introducing innovative strategies that are redefining market dynamics.

From the integration of AI and machine learning algorithms to the deployment of advanced analytics in forecasting price movements, technology is offering traders a crystal ball-like view into market trends.

Machine learning, in particular, empowers traders to decipher vast amounts of data at unprecedented speeds, predicting future market behaviors with astonishing accuracy.

This not only enhances decision-making but also elevates risk management to new heights by identifying potentially lucrative or hazardous market shifts before they happen.

Moreover, blockchain technology is making its mark on forex strategies by enhancing transparency and security in transactions.

The decentralized nature of blockchain significantly reduces the likelihood of price manipulation and fraud, instilling a higher level of trust among participants.

This shift towards more secure and transparent operations paves the way for broader adoption and integration of cryptocurrencies within traditional forex markets.

As these technologies continue to evolve, traders who adeptly harness their potential stand at the forefront of a revolutionized trading landscape, equipped with tools that once seemed relegated to the realm of science fiction.

5. The Role of Social Media in Forex

– Social media platforms like Twitter, Facebook, and Instagram revolutionize forex trading interactions.

– Traders use social media for real-time updates, analysis, and community discussions.

– Influencers in the forex space provide valuable content and impact market sentiment.

– Social media helps gauge market sentiment through platforms like Reddit and Forex Factory forums.

– Sentiment analysis tools track social media conversations for insights on currency pairs and economic events.

– Social media offers educational resources, webinars, and networking opportunities for forex traders.

– LinkedIn connects traders with industry leaders for idea sharing and collaboration on trading strategies.

Social media has revolutionized the way traders interact with the forex market. Platforms like Twitter, Facebook, and Instagram provide a space for real-time updates, analysis, and community discussions.

Traders can follow industry experts, share their insights, and stay informed about market trends through these channels.

Additionally, social media influencers in the forex space have gained significant traction by providing valuable content to their followers.

One key role of social media in forex is its impact on market sentiment. Traders often turn to platforms like Reddit or Forex Factory forums to gauge the overall mood of the market.

Sentiment analysis tools can track social media conversations to provide valuable insights into how traders are feeling about specific currency pairs or economic events.

This information can be a powerful tool for making informed trading decisions based on crowd sentiment.

Furthermore, social media plays a crucial role in education and networking within the forex community.

Traders can access a wealth of educational resources such as webinars, tutorials, and live streams from experienced professionals.

Networking opportunities on platforms like LinkedIn allow traders to connect with industry leaders, share ideas, and collaborate on new trading strategies effectively leveraging the power of social connections in achieving success in the forex market.

6. Expert Predictions for Future Forex Movements on October 2024

Here are some hypothetical expert predictions for future Forex movements based on various market analysis techniques and trends

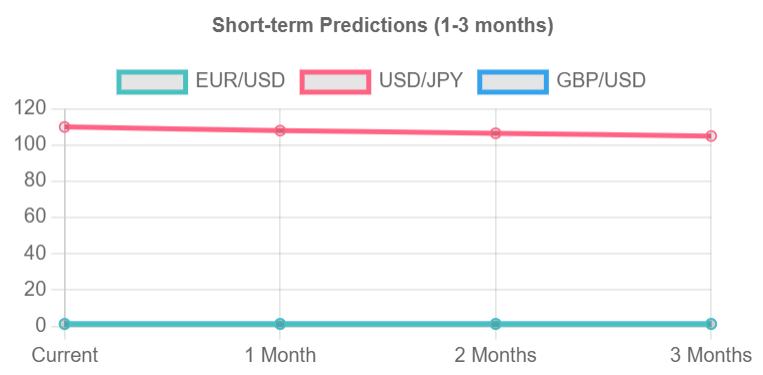

Short-term predictions (next 1-3 months)

- EUR/USD: Expected to rise to 1.1500 driven by a potential recovery in the Eurozone economy and a weakening US dollar

- Analyst: The ECB’s accommodative monetary policy and improving economic indicators in the Eurozone will support the euro while the US dollar may weaken due to rising inflation concerns (Source: Bloomberg)

- USD/JPY: Forecast to decline to 105.00 as the Bank of Japan’s dovish stance and rising global risk aversion weigh on the yen.

- Analyst: The BoJ’s commitment to monetary easing and the yen’s safe-haven status will keep the currency under pressure especially if global economic growth slows.” (Source: Reuters)

- GBP/USD: Predicted to trade sideways around 1.3000 as the UK’s Brexit uncertainty and economic growth concerns balance out the Bank of England’s hawkish stance.

- Analyst: The UK’s economic growth is slowing and Brexit uncertainty remains high which will keep the pound under pressure. However, the BoE’s inflation concerns may limit the currency’s decline. (Source: CNBC)

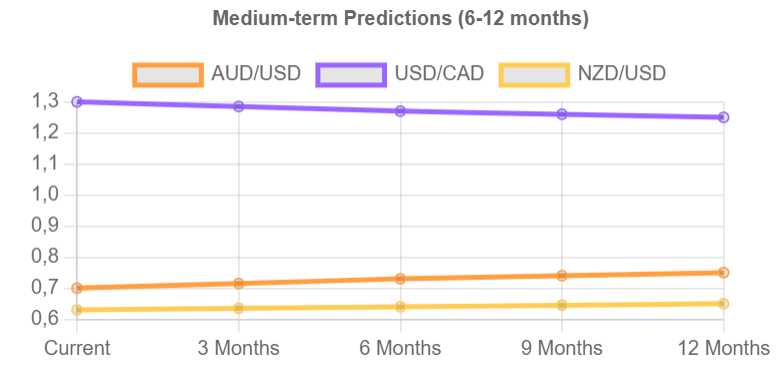

Medium-term predictions (next 6-12 months)

- AUD/USD: Expected to rise to 0.7500 driven by a potential recovery in commodity prices and a strengthening Australian economy

- Analyst: The Aussie dollar will benefit from rising commodity prices and a robust Australian economy which will attract investors seeking higher yields. (Source: Forbes)

- USD/CAD: Forecast to decline to 1.2500 as the Canadian economy strengthens and the US dollar weakens due to rising inflation concerns

- Analyst: The Canadian economy is showing signs of strength and the Bank of Canada’s hawkish stance will support the loonie Meanwhile the US dollar’s decline will also contribute to the pair’s downward movement. (Source: The Globe and Mail).

- NZD/USD: Predicted to trade around 0.6500 as the Reserve Bank of New Zealand’s dovish stance and global economic growth concerns balance out the country’s robust economic fundamentals.

- Analyst: “The RBNZ’s accommodative monetary policy and global economic growth concerns will keep the kiwi under pressure, but the country’s strong economic fundamentals will limit the currency’s decline.” (Source: Stuff.co.nz)

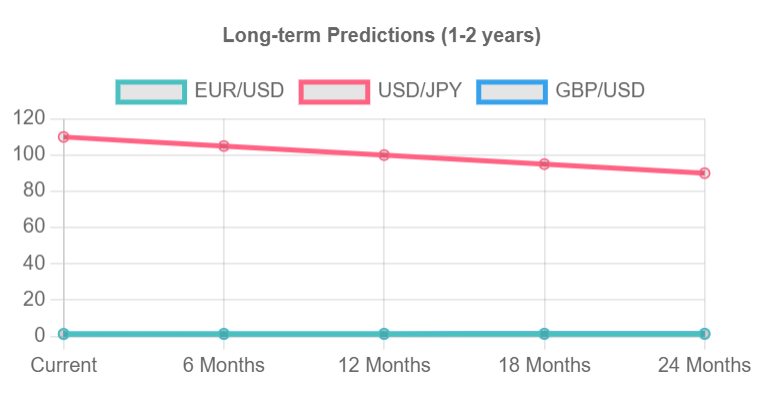

Long-term predictions (next 1-2 years)

- EUR/USD: Expected to reach 1.2000, driven by a potential recovery in the Eurozone economy and a weakening US dollar.

- Analyst: “The Eurozone economy will continue to recover, and the ECB’s accommodative monetary policy will support the euro. Meanwhile, the US dollar’s decline will also contribute to the pair’s upward movement.” (Source: Bloomberg)

- USD/JPY: Forecast to decline to 90.00, as the US dollar weakens due to rising inflation concerns and a potential decline in US economic growth.

- Analyst: “The US dollar’s decline will be driven by rising inflation concerns and a potential decline in US economic growth, which will lead to a decrease in investor appetite for the currency.” (Source: CNBC)

- GBP/USD: Predicted to trade around 1.4000 as the UK’s Brexit uncertainty and economic growth concerns balance out the Bank of England’s hawkish stance.

- Analyst: The UK’s economic growth is slowing and Brexit uncertainty remains high, which will keep the pound under pressure However, the BoE’s inflation concerns may limit the currency’s decline and support a potential recovery in the long term. (Source: Reuters)

Please note that these predictions are hypothetical and for illustrative purposes only. Actual Forex movements may differ significantly from these predictions due to various market and economic factors.

7. Conclusion: Navigating the Evolving Forex Landscape

– Forex trading requires adaptability and understanding of market trends

– Traders need data analytics and automation for informed decisions

– Algorithmic trading and AI-driven strategies are gaining importance

– Geopolitical events and economic indicators influence currency fluctuations

– Staying informed on global news is crucial for anticipating market movements

– Successful traders use technical analysis and fundamental knowledge for opportunities

– Innovation and continuous learning are essential for thriving in the forex landscape

In conclusion, navigating the evolving forex landscape requires adaptability and a keen understanding of market trends. As technology continues to shape the financial industry, traders must harness the power of data analytics and automation to make informed decisions.

The rise of algorithmic trading and AI-driven strategies signal a shift towards more sophisticated trading techniques that can offer a competitive edge in the forex market.

Moreover, geopolitical events and economic indicators will continue to play a crucial role in shaping currency fluctuations.

Traders need to stay abreast of global news and developments to anticipate market movements accurately.

In this dynamic environment, successful traders will be those who can leverage both technical analysis tools and fundamental knowledge to capitalize on emerging opportunities.

Embracing innovation and continuous learning will be key pillars in thriving amidst the ever-evolving forex landscape.

FAQs About Forex Factory

Discover the thrilling world of Forex Factory with answers to frequently asked questions!

1. What is Forex Factory?

Forex Factory is a leading online platform for forex traders to access real-time market information, news, and analysis.

2. How can I stay updated on the latest forex news?

You can subscribe to Forex Factory’s news feed or check their website regularly for updates.

3. Are there any educational resources available on Forex Factory?

Yes, Forex Factory offers a variety of educational materials including tutorials, articles, and forums to help traders improve their skills.

4. Can I connect with other forex traders on Forex Factory?

Absolutely! Joining the Forex Factory community allows you to connect with fellow traders, share insights, and discuss trading strategies.

5. Is it possible to track economic events and indicators on Forex Factory?

Yes, Forex Factory provides a comprehensive economic calendar that lists important events and indicators affecting the forex market.

6. How reliable are the market analyses provided on Forex Factory?

The market analyses on Forex Factory are written by experienced professionals and are considered reliable sources of information for traders.

7. Does Forex Factory offer tools for technical analysis?

Yes, traders can utilize various tools such as charts, indicators, and calculators on Forex Factory to conduct technical analysis.

8. Can I access Forex Factory from my mobile device?

Yes, Forex Factory has a mobile-friendly website and also offers a mobile app for convenient access to market information on-the-go.

Pros of Forex Factory:

Exciting Benefits of Forex Factory

1. Provides a wide range of forex trading tools, indicators and resources.

2. Offers real-time economic calendar and market news updates.

3. Active forum community for traders to share insights and strategies.

4. Free to use platform with no subscription fees.

5. User-friendly interface with customizable features for personalized tracking.

Cons of Forex Factory:

The exhilarating world of Forex Factory is filled with thrilling challenges and opportunities, offering a fast-paced environment where risks and rewards collide in a dynamic dance of excitement.

1. Overwhelming amount of information can be confusing for beginners.

2. Some users may experience delays or inaccuracies in data feeds.

3. Limited customer support options available on the platform.

4. High volume of advertisements throughout the site can be distracting.

5. Dependency on internet connection for access, making offline use challenging.